ComBank Group end 2021 with solid growth, income of Rs 163.675 billion

The Commercial Bank Group has ended 2021 with a gross income of Rs 163.675 billion, an improvement of 7.70%, with interest income accounting for more than 80% of the top line in a year of mixed fortunes. The Group reported an interest income of Rs 132.818 billion for the year ended 31st December 2021, reflecting a growth of 7.04%.

The final quarter of the year saw interest income growing by 17.84% to Rs 36.592 billion and accounting for more than 83% of the Group’s three-month gross income of Rs 43.625 billion. Total operating income for the year under review grew by 21.98% to Rs 93.598 billion, and the Group’s impairment charges and other losses increased by 17.37% to Rs 25.140 billion.

Net operating income for the full year improved by a healthy 23.77% to Rs 68.458 billion but grew by a comparatively lower rate of 7.89% to Rs 17.504 billion due to the higher impairment charges provided in the fourth quarter. Total operating expenses increased by 12.93% to Rs 29.658 billion consequent to an increase in personnel expenses following the signing of a Collective Agreement effective January 2021.

Operating profit before VAT on Financial Services grew by a noteworthy 33.58% to Rs 38.801 billion and the Group’s VAT on Financial Services for the year increased by 28.99% to Rs 5. 845 billion, while profit before income tax for the year improved by 34.41% to Rs 32.957 billion.

Taken separately, Commercial Bank of Ceylon PLC reported a profit before tax of Rs 32.001 billion for the year under review, achieving a robust growth of 36.11% and profit after tax of Rs 23.606 billion, recording an improvement of 44.17%.

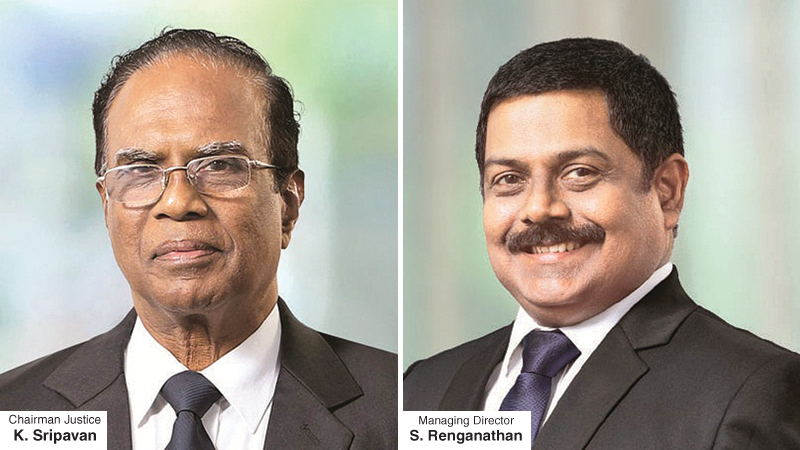

Commenting on these results, Commercial Bank Chairman Justice K. Sripavan said: “The performance of the Group can be described as exceptional when the external challenges of the year are factored in.”

Commercial Bank Managing Director and Group CEO S. Renganathan pointed out that the Bank was able to improve on its key performance ratios in 2021, to become even more financially stable and better-positioned to continue its mission as a systemically important bank.

Total assets of the Group grew by Rs 221 billion or 12.54% over the year to reach Rs 1.983 trillion as of 31st December 2021.

Gross loans and advances of the Group increased by Rs 133 billion or 13.83% to Rs 1.095 trillion, recording a monthly average growth of Rs 11 billion over the 12 months.

Total deposits of the Group recorded an improvement of Rs 186 billion or 14.46% in the 12 months reviewed at a monthly average of Rs 15.5 billion to reach Rs 1.473 trillion.