First Capital Research in their Pre-Policy Analysis for April 2002 views that at the upcoming policy meeting, there is a strong case for a sharp increase in policy rates in order to compensate for higher inflation and to preserve the currency and foreign reserves.

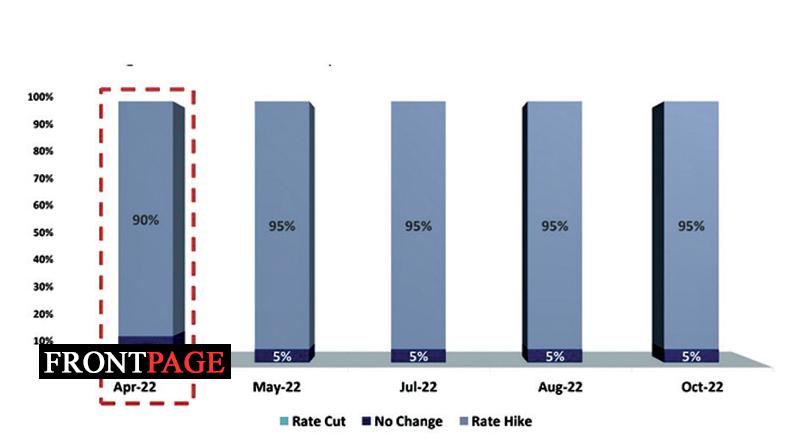

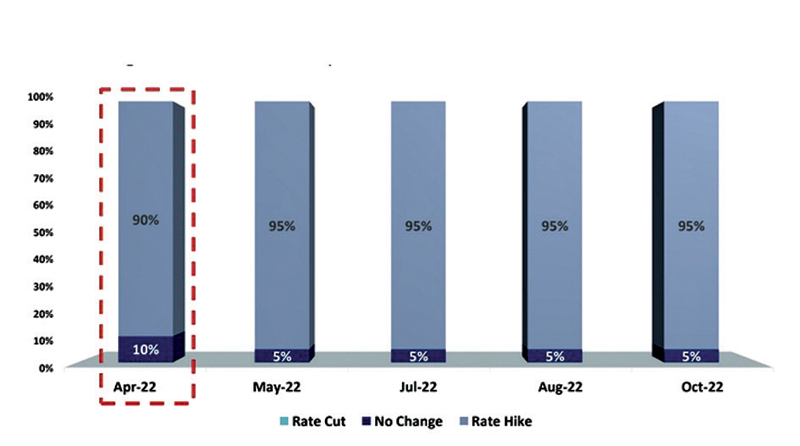

“As a result, we believe that there is a very high probability of 90% for a hike to iron out the prevailing imbalances in the domestic financial markets and the external sector of the economy, while preempting the buildup of any excessive inflationary pressures over the medium term, thereby supporting macroeconomic stability.” Tightening policy stance is one of the key propositions by the IMF as well. Given rising inflationary pressures and expectations, IMF believes that near-term monetary policy tightening is warranted to ensure that the recent breach of the inflation target band is only temporary.

“Therefore, CBSL is expected to deliver a minimum of 100 bps or more rate hike at the monetary policy meeting scheduled on April 22. However, there is also a lower probability of 10% to maintain the policy rates at its current level in order to further improve the high frequency indicators.”

First Capital also notes that derailing foreign reserves have also led to significant pressure on the currency and since CBSL’s decision to allow the flexibility in the currency on March 7 the rupee depreciated significantly by more than 40% while in unofficial trading platforms the rupee being quoted at an even far weaker rate. ‘Hence, to arrest the existing pressure on the currency and reserves, we believe that CBSL should tighten its policy rates. “

Recovering from a steep contraction in GDP in 2020, Sri Lanka’s economy has embarked on a gradual recovery during 2021 recording a GDP growth of 3.7%.

“However, The domestic economy is expected to be somewhat affected by recent adverse developments such as supply chain disruptions and rising commodity prices, as well as power and energy supply interruptions. These disruptions have to be addressed immediately to ensure the continuation of uninterrupted domestic production and the momentum in exports, while continuing the efforts to strengthen the production economy through well-targeted growth policies. Therefore, further pampering in terms of fiscal and monetary stimulus may be required in near to medium term to stabilize the economic growth.”

With the Bank of England having already moved on to higher interest rates, the European Central Bank is likely to wait until the end of the year to raise rates, First Capital said, commenting on the global scenario.