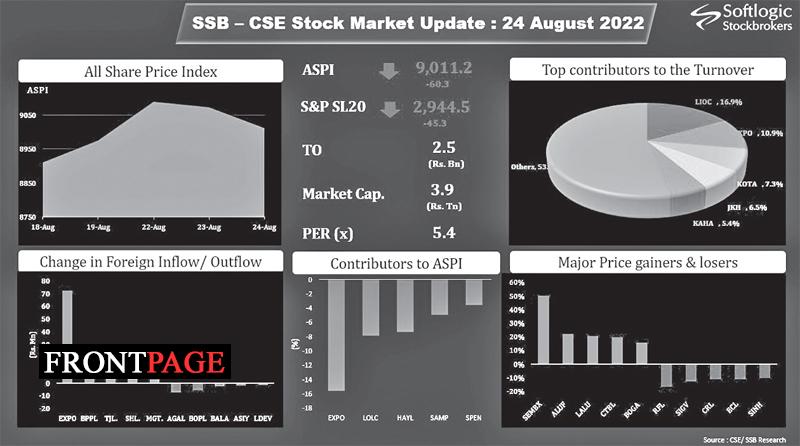

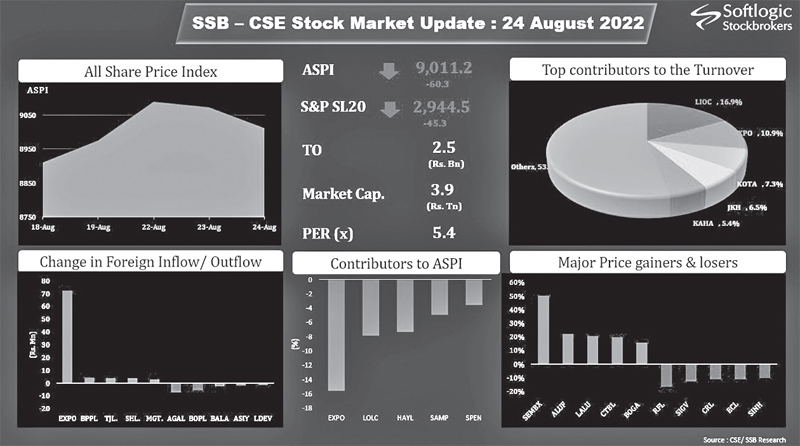

Bourse slips further on speculation of domestic debt restructuring

Colombo bourse witnessed profit taking further yesterday on index heavy counters and most banking sector counters due to a speculation of domestic debt restructuring.

On the other hand, both Central Bank Governor Nandalal Weerasinghe and the co-cabinet spokesperson have said that a local debt restructuring will not take place as it will collapse the already illiquid banking system.

Thus, All-Share Price Index decreased by 60.3 points (-0.7%) to close at 9,011.2 for the day whilst S&P SL20 Index also dropped by 45.3 points (-1.5%) to close at 2,944.5. Expolanka Holdings, LOLC Holdings, Hayleys, Sampath Bank and Aitken Spence remained as the top negative contributors to the ASPI during the day. Further, broader market’s total turnover stood at Rs. 2,549.4 mn against the 12-month average daily turnover of Rs. 4,469.7 mn, whilst the volume traded for the day was 115,990.3k against the 12-month average daily volume of 213,744.9k. Diversified Financials and Telecommunications mostly contributed to yesterday’s turnover.

The top turnover generators for yesterday were Lanka IOC Rs.430.9 mn (+0.0%), Expolanka Holdings Rs. 227.4 mn (-3.6%), Kotagala Plantations Rs. 187.2 mn (+9.2%), John Keells Holdings Rs. 164.7 mn (-0.2%), and Kahawatte Plantations Rs. 136.8 mn (+10.9%). Foreigners recorded a net inflow of Rs. 68.9 mn yesterday. Foreign purchases stood at Rs. 94.8 mn whilst total foreign sales amounted to Rs.25.9 mn. Top foreign buying counters EXPO LKR. 72.2 mn, BPPL LKR. 3.9 mn, TJL LKR. 3.6 mn, SHL LKR. 3.6 mn, MGT LKR. 2.3 mn and HOPL LKR. 1.6 mn whilst top foreign selling counters were AGAL LKR. (7.2) mn, BOPL LKR. (5.4) mn, BALA LKR. (2.4) mn, ASIY LKR. (1.9) mn, LDEV LKR. (1.1) mn and EML LKR. (1.0) mn. Further, off-board transactions were witnessed in John Keells Holdings (Rs.159.2 mn), Kahawatte Plantations (Rs.36.5 mn) and Horana Plantations (Rs.30.5 mn) yesterday.

Courtesy Solftlogic Stockbrokers