In November 2020, in midst of global pandemic, after eight years of economic and Political considerations much talked Regional Comprehensive Economic Partnership (RCEP) was signed among ten Southeast Asian countries Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam together with their FTA partners such as South Korea, China, Japan, Australia and New Zealand.

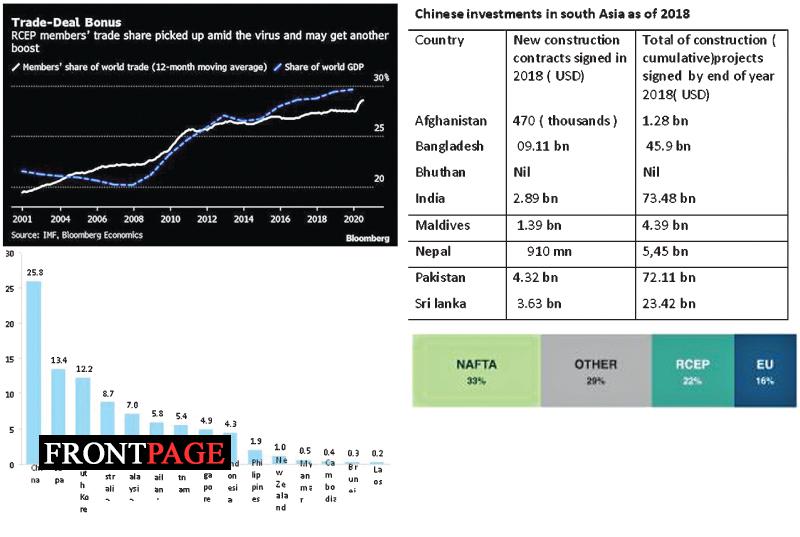

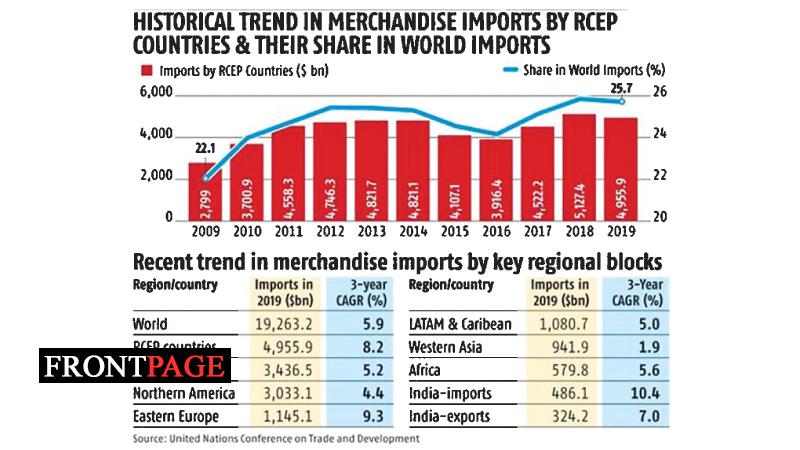

The new free trade bloc of 15 states will be the biggest surpassing both the US-Mexico-Canada agreement and the European Union. The total population of RCEP is 2.1 billion people and account for 29% of Global Domestic production. The Peterson Institute for International Economics estimates the deal could increase global national income by $186bn annually by 2030.

Salient features and Perceived benefits under RCEP:

Ajith D. Perera |

(a) Consolidated Rule Book for trade in all 15 member states: It provides harmonizing the information requirements such as procedures for approved exporters to make declaration of origin, transparency around import, export and licensing procedures; issuance of advance ruling; prompt customs clearance and expedited clearance of express consignment; use of IT infrastructure to support customs operations; trade facilitation measures for authorized operators and local content standards for businesses to be eligible to the preferential terms of the agreement within RCEP to avoid the complexities and operational issues in each FTA.

(b) Introduction of Common Certificate of Origin: Generally the cost of rules of origin ranges between 1.4% and 5.9% of the export transaction amounts. Common rule of origin could reduce export costs, thereby boosting merchandise exports among signatories by around USD 90 billion on average annually.

Estimated average potential gains (USD billion) under common rules of origin of RCEP in annual intra-zone merchandise given below.

Undoubtedly the signing of the RCEP is an achievement for China amidst the economic turmoil around the world, ongoing U.S.-China trade tensions and emerging trade protectionism promoted by national governments.

However in effect the deal is likely to benefit not only China but also Japan and South Korea more than other member states due to the enormous capacities of these countries.

Non Tariff Measures (NTM): RCEP prohibits imposition of NTM’s on the importation or exportation between member states except in accordance with the rights and obligations under the WTO Agreement or the RCEP. Over time when the RCEP becomes fully operational it will not only lead to greater efficiency and ease of doing business in the RCEP trade block, but it could also make the region more attractive to further diversification of supply chains for multinational companies.

Winners and losers at Global Trade War

Trade is meant to create win-win situation but global trade war produce winners, losers and naturally no exceptions for Trade Agreements. So who will be the best loser when RCEP works fully? Answer might be India and USA. India was also part of the initial negotiations but it pulled out later over concerns that lower tariffs could hurt local producers. The question is has India detected early warning signals? It is only the time that can prove it. However, some believe that If India joined RCEP sectors like pharmaceuticals, cotton yarn and the services industry can make substantial gains.

According to the Economic times of India central government has set a very ambitious target of USD 300 billion by 2025 for trade with ASEAN economies. One of the main challenges for India now is when ASEAN countries join the RCEP with the inclusion of China, which is known as the “World Factory” will their buyers continue to purchase from India? Conversely, can China grab sizable market share from India?

It now depends on the level of activation of RCEP and the India’s product offer which includes the measures taken to reduce the cost of the transaction to ASEAN countries through already signed trade agreements. India has set an export target of USD 1 trillion for 2025 and as a result India is eying for early harvest Agreements with number of countries such as UK, Australia, Israel, Canada and GOC countries India’s recent overture to EU to resume once stalled trade negotiations in 2016 could also be best explained in the light of the new challenges. However, despite these measures, India can still consider joining the RCEP in the future.

RCEP marks another unusual happening in the history of trade. That is the absence of United States of America from two major trade blocks of the world such as RCEP and TPP.

However distribution of total USA exports show that USA exported sizable amount of goods (22%) to RCEP countries before signing the RCEP. Can USA continue this volume once the RCEP was made operational?

Belt and Road (B&R) Initiative

(7a) How B&R initiative helps China’s economic and political goals?

B&R initiative works in many ways to help China’s economic and political aspirations. some of the notable features are switching development from eastern coast to western parts of the country, which contributed only 7.8% of china’s total foreign trade by value in 2015, protecting China’ growing energy demand through smooth supply of crude oil mostly flows from middle east through maritime connectivity, addressing the issue of over capacity of production, Internationalization of RMB and protecting Geo strategic interest in Indian and Pacific Ocean.

This also includes economic corporation, building infrastructure and creating bilateral relation to revive the trading system along the ancient Silk Road.

China often say B & R initiative has its roots in five principles of peaceful Co- Existence signed by India and China in 1954 position of which however can be debated due to the alleged military action of China in the border conflict in 1962.

(7b) Impact of B&R and South Asia.:

Economically least integrated SAARC countries, which has a population of 1.8 billion representing 25% of the world population needs such a strategic economic cooperation to uplift its economies and the quality of life of the people.

It’s a well-known fact that south Asia Struggle in attracting investment within the region. In the recent past South Asia and Southeast Asia got the lion share of Chinese outbound FDI.

Challenges posed by B & R initiative to China:

Even though B&R initiative is a success, it also faces some challenges internally and externally. The internal issues are absorption of over production during crisis situations like pandemic, trade diversion through trade agreements by aid recipients and externally mounting pressure by political and civil activities on the issues such as depriving job opportunities for locals, increase in green field projects and issues over land clearance and alleged permission granted for military involvement to protect Chinese investments in south Asian countries.

Despite the China’s visionary B&R initiative it still takes no chances but consolidating its local development to meet the global competition. In February 2019 China launched another initiative within its territories. It is the formation of Guangdong – Hong Kong – Macau Greater Bay Area (GBA).

Under this move China wants to strengthen the strategic development prototyping and fast engineering through creating synergies under one-country two systems.

Today in the south and east parts of the globe China has an unbeatable edge over USA or EU on trade due to the robust approach of its foreign trade policy and opportunities provided by regional trade agreements such as RCEP and Bilateral trade agreements signed with other countries.

RCEP, Regional Trade agreements and Trade Policy Implications for Sri Lanka:

Sri Lanka is now in the process of formulating a new trade policy. In this context, Sri Lanka need to be mindful of latest trends and new developments taking place in the region due to RCEP or any other regional/bilateral trade agreements between China and other countries. At present after India China has already become the second biggest sourcing destination for Sri Lanka. China’s imports from Sri Lanka’s record a nominal volume. (USD 252 million only (2020). China’s exports to Sri Lanka stood at USD 3.58 billion in 2020. (UN COMTRADE). Sri Lanka’s main exports to China as of 2020 were Apparel, Tea, Paper yarn and woven fabrics, Activated carbon, Electronic integrated circuits and micro-assemblies. Retreaded/used pneumatic tires of rubber and Fish frozen. In fact, except for “Ceylon Tea” RCEP members produce almost every product in the above list.

Therefore, it is a moot point whether policy makers have analyzed the impact of trade in the RCEP vis-à-vis the ASEAN free trade area, and the implications thereof to Sri Lanka’s interests in the region. Moreover, considering that the direction of Sri Lanka’s major markets are neither in the ASEAN nor in the RCEP, it is vital to conduct studies as to the trade competitiveness and compatibilities between the new markets of the far east who are engaged in these regional agreements and Sri Lanka.

Now the Interesting question is what will be the short term and long-term impact on Sri Lankan exports to china and East Asia due to RCEP? The writer’s answer is even if Sri Lanka retains its market share on the short-term Sri Lanka’s chances for future export growth to China and other RCEP countries can be substantially affected If no remedial action is taken by Sri Lanka.

Strategic Approach and Remedial Actions available for Sri Lanka;

Sri Lanka needs to first develop a strategy to retain the current export market share and secondly to develop a strategy to capture more export volumes through new markets.

Option (A) Use of APTA (Asia Pacific Trade Agreement) to promote export to China. (APTA includes India, Bangladesh, South Korea, Lao, Mongolia as well)

(1) Sri Lankan government needs to address the issue of Non-Tariff Barriers with China/India and win more concessions available under APTA’ a Special and Differentiated Treatment- (SDT) and Small and vulnerable Economies (SVE) both within an agreed time period.

(2) Sri Lankan government can consider subject to WTO compliances on the granting of subsidies and incentives/marketing arrangements for selected Sri Lankan products to enter in to Chinese and Indian market for a particular period.

(3) Aggressive trade awareness campaigns on the process, procedures, and regulations specially involving exposition of Chinese language/provincial dialect for business communications, actual business practices in China could be arranged through Sri Lankan missions in China and elsewhere to meet buyers and sellers (need not be confined to Chinese market) to secure more volumes for Sri Lankan products. Available sources and the commitment of Sri Lankan Foreign Service and department of commerce have to be effectively used through motivation and recognition. Inclusion of capable professionals from other streams may be a good option but what is finally important is building competences required to achieve the goal.

Option (B)

(1) Negotiating an early harvest agreement to reduce the trade deficit gap as a precursor for any future comprehensive trade agreement: This approach is relevant especially to China and India where already there is a big trade deficit unfavorable to Sri Lanka. This could take the form of a Bilateral Preferential Trade Agreement on Goods, which was earlier mooted, between the two countries. The primary advantage of a Bilateral Preferential Trade Agreement (if negotiated under the Multilateral Trade Rules of GATT/WTO Enabling Clause) on Goods over a more comprehensive Free Trade Agreement that covers an array of sectors is that it takes into account the vast asymmetries’ existing between the giant Chinese/Indian and Sri Lanka and to liberalize only selected sectors in keeping with its status as a small developing trading partner without undertaking vast scale liberalizing initiatives.

Suggestions to improve the capacity of Sri Lanka’s Trade

Writer welcomes the recent budget proposal to establish a National Single Window to reduce the cost of transaction and improve the efficiency for exporters and importers especially SME’s in the country. As a national priority Sri Lanka also needs to rationalize the HS codes which are very complex by nature which puts country at a disadvantage at trade negotiations. Further Sri Lanka is needed to set up a National Productivity Commission consists of experts and industrialists to address the issue of low productivity of our major industries.

Frame work for a new Trade Policy: Any future trade policy of Sri Lanka must have a robust and practical approach to solve the issue of exports to china and India and SME contribution to export. The writer suggests Trade ministry firstly to focus on export-oriented framework for Foreign Trade based on creation of wealth, Technology, Innovation, Inclusiveness, Investments and productivity. Therefore any new Trade policy document needs to provide provisions for a proper study on economic modeling for future trade agreements and assessing the overall export competiveness of Sri Lankan product offer and how good Sri Lanka in matching the competitors product offer comes from RCEP or any other bi lateral trade agreements signed by countries such as China and India.

It’s also pertinent to have an Impact analysis of existing trade agreements, review of rules of origin to avoid circumvention and fraud which happed in the past and future prospects. The country also needs to set up a high-powered National Advisory Committee for trade.

The writer also suggests approving a transparent procedural and regulatory infrastructure for implementation of Rules of Origin prior to FTA negotiations. Sri Lankan government needs to provide proper guidelines for trade negotiation process and should not under value the International Trade Negotiations’ Tool kit developed by Department of Commerce in the past.

General trade negotiations

It is an apparent fact that when general trade negotiations are entered into by Sri Lanka at the behest of narrow geo-political interest without actually engaging in economic and pragmatic business outlook for such decisions. More often than not “joint studies” are done merely to wrap up a decision to enter into trade agreements without conducting a proper analysis, assessment of the ground situation and cost benefit analysis.

It is also recommended to study the policies of other countries Reg trade agreements giving a direction to the involvement of country legislature, selection of countries for agreements, appointment of negotiators, stakeholder consultation, Provision for periodical review of the trade agreement.

In fact, the checklist for Sri Lanka to upgrade the capacity goes on and on. E.g. Sri Lanka‘s position in the global value chain (GVC), developing the country production capacity and the productivity.

Further a mechanism to promote a point of difference/overseas protection of branding for Sri Lankan products and services, ( GIS) paying a ‘reward’ for encouraging innovation, and a strategy to mitigate the ill effects of COVID-19 such as clearance issues at ports and freight rates needs to be considered without hesitation. Finally, production of high tech items and extensive use of Exclusive Economic Zone at sea can create a change in the Sri Lanka’s export landscape.

The new trade policy has to help Sri Lanka reach the required capacity to join a big league like RCEP or sign effective trade agreements within a specific period. Signing any trade agreement without enhancing the country capacity will only result in another ineffective trade agreement like indo – Sri Lanka Trade agreement or South Asian Free Trade Agreement. Finally Its worthy to note the slaying of Philip Hammond –British politician, chancellor of the Exchequer from 2016-2019 and foreign Minister from 2014- 2016, “While I believe firmly in open markets and free trade, I also believe an open market needs a level playing field.”

(The writer is a scholar, writer and a speaker on trade and presently serves at Federation of Chambers of Commerce and Industry of Sri Lanka (FCCISL) in the capacity of Secretary General/CEO. He was the founder of chamber of commerce and Industry under Asia Pacific Trade Agreement which received the consensus of APTA countries at the 50th. Standing Committee meeting held at UNESCAP in Bangkok in 2017. He also served on the constitutional review committee of SAARC Chamber of Commerce and Industry in Pakistan from 2015-2016.)