Bourse dips on proposed tax impacts – Acuity Stockbrokers

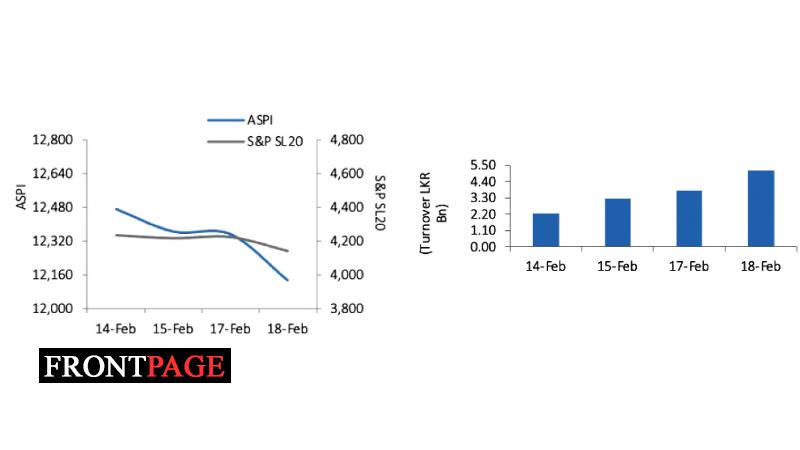

The Bourse ended the week on a negative note this week with ASPI decreasing by 325.76 points (or 2.61%) to close at 12,134.04 points, while the S&P SL20 Index also decreased by 78.77 points (or 1.87%) to close at 4,140.65 points.

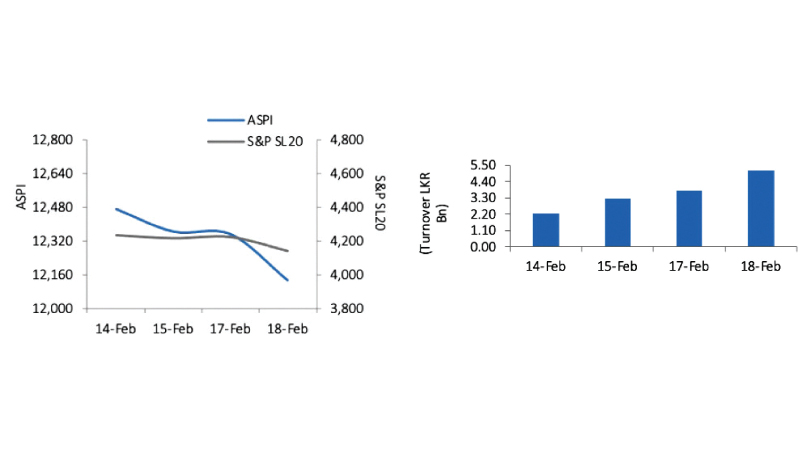

LOLC Finance was the highest contributor to the week’s turnover value, contributing LKR 4.17Bn or 28.84% of total turnover value. Comm Lease & Fin followed suit, accounting for 12.84% of turnover (value of LKR 1.86Bn) while Expolanka contributed LKR 1.00Bn to account for 6.95% of the week’s turnover. Total turnover value amounted to LKR 14.45 Bn (cf. last week’s value of LKR 23.27 Bn), while the daily average turnover value amounted to LKR 3.61 Bn (-22.37% W-o-W) compared to last week’s average of LKR 4.65 Bn. Market capitalization meanwhile, decreased by 2.33% W-o-W (or LKR 132.16 Bn) to LKR 5,533.43 Bn cf. LKR 5,665.59 Bn last week. Liquidity (Value & Volume)

Diversified Financials Industry Group was the highest contributor to the week’s total turnover value, accounting for 51.15% (or LKR 7.39Bn) of market turnover. Industry Group’s turnover was driven primarily by Lolc Finance, Comm Lease & Fin, Vallibel Finance and LOLC Holdings which accounted for 89.09% of the sector’s total turnover. Capital Goods Group meanwhile accounted for 11.32% of the total turnover value while Food Beverage & Tobacco Industry Group contributed 10.75% to the weekly turnover.

The Diversified Financials Industry Group dominated the market in terms of share volume, accounting for 55.10% (or 294.31 Mn shares) of total volume, with a value contribution of LKR 7.39Bn. The Food Beverage & Tobacco Industry Group followed suit, adding 15.24% to total volume (81.39 Mn shares) while the Materials Group contributed 4.73% (25.28 Mn shares) to the weekly share volume.

Company, DPS(Rs.), Dividend Type, Date (XD) ; MERCANTILE INVESTMENTS AND FINANCE PLC, 0.35, Second Interim, 22-Feb-22; PGP GLASS CEYLON PLC, 0.25, Second Interim, 25-Feb-22; SAMPATH BANK PLC, 4.25, First and Final dividend, 31-Mar-22; TEEJAY LANKA PLC, 0.85, First Interim, 28-Feb-22; COMMERCIAL CREDIT AND FINANCE PLC, 1, First Interim, 28-Feb-22; HNB ASSURANCE PLC, 3.2, First and Final dividend, 1-Apr-22; NESTLE LANKA PLC, 20, First Interim, 2-Mar-22; NESTLE LANKA PLC, 35, Final Dividend, 13-Jun-22; HATTON NATIONAL BANK PLC (VOTING), 6.5, Final Dividend, 31-Mar-22; HATTON NATIONAL BANK PLC (NON-VOTING), 6.5, Final Dividend, 31-Mar-22.

Company, Proportion, Dividend Type, No.of shares; DFCC BANK PLC, 01:19.6, Scrip Dividend, 16,325,421; HATTON NATIONAL BANK PLC (VOTING), 01:55.5, Scrip Dividend, 7,583,061; HATTON NATIONAL BANK PLC (NON-VOTING), 01:50.8, Scrip Dividend, 2,067,808.

Prime Lending Rate: 8.42%; Ave. Wtd. Deposit Rates: 5.01%; Ave. Wtd. Fixed Dep. Rates: 6.05%; CCPI Inflation Y-o-Y %: 14.2%. Net Foreign Position

Foreign investors were net sellers this week with a total net outflow amounting to LKR 0.07 Bn relative to last week’s total net outflow of LKR 0.40 Bn (82.2% W-o-W). Total foreign purchases decreased by 66.2% W-o-W to LKR 0.16Bn from last week’s value of LKR 0.48Bn, while total foreign sales amounted to LKR 0.23Bn relative to LKR 0.89Bn recorded last week (-73.5% W-o-W).