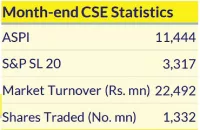

The Colombo Bourse closed positive in March, with the benchmark All Share Price Index (ASPI) rising +7.4% MoM to 11,444 points (an increase of 793 index points), says CT CLSA – Market Statistics Report compiled for March 2024.

Meanwhile, the more liquid S&P SL20 index increased +9.2% MoM to 3,318 points (an increase of 280 index points). Average daily turnover increased to Rs.1,867mn in March 2024 (vs. Rs.1,728mn in February 2024). Top contributors to monthly turnover were LOLC Finance (LOFC, Rs.4,848 mn, 882mn shares), Sampath Bank (SAMP, Rs.1,821 mn, 23 mn shares), and Hatton National Bank (Voting) (HNB-N, Rs.1,512 mn, 9mn shares).

Meanwhile, the more liquid S&P SL20 index increased +9.2% MoM to 3,318 points (an increase of 280 index points). Average daily turnover increased to Rs.1,867mn in March 2024 (vs. Rs.1,728mn in February 2024). Top contributors to monthly turnover were LOLC Finance (LOFC, Rs.4,848 mn, 882mn shares), Sampath Bank (SAMP, Rs.1,821 mn, 23 mn shares), and Hatton National Bank (Voting) (HNB-N, Rs.1,512 mn, 9mn shares).

A net foreign outflow of Rs.4,260 mn was recorded in March 2024 following a net foreign outflow of Rs.1,530mn in February 2024. The contribution of foreign activities to market turnover was 10% in March 2024. During the month, net foreign buying was seen in ACL Cables (ACL, +Rs.226 mn), Sanasa Development Bank (SDB, +Rs.177 mn), and Melstacorp (MELS, +Rs.124mn), whilst net foreign selling was seen in LOLC Finance (LOFC, -Rs.3,855 mn), John Keells Holdings (JKH, -Rs.303mn), and LOLC Holdings (LOLC, -Rs.182 mn).

The post Market rebounds by +7% in March amid higher net foreign outflows appeared first on DailyNews.