Understanding dynamics of illicit tobacco in Sri Lanka

Research Intelligence Unit (RIU) launched its latest report on the economics of tobacco taxation providing a macro-level overview of the tobacco industry in Sri Lanka, including the illicit market. The report is aided with preliminary results of an ongoing tobacco consumer and retailer primary survey. Understanding the nature of the overall tobacco market with special focus on the illicit segment is pivotal to comprehending the impact it has on the local economy, including particularly the erosion of revenue of the Treasury.

The World Health Organisation (WHO) has revealed that Sri Lanka is the most expensive country in the world to purchase cigarettes in 2020, based on Purchasing Power Parity (PPP), making the country a “high price hot spot” and a prime target for the global illicit tobacco trade.

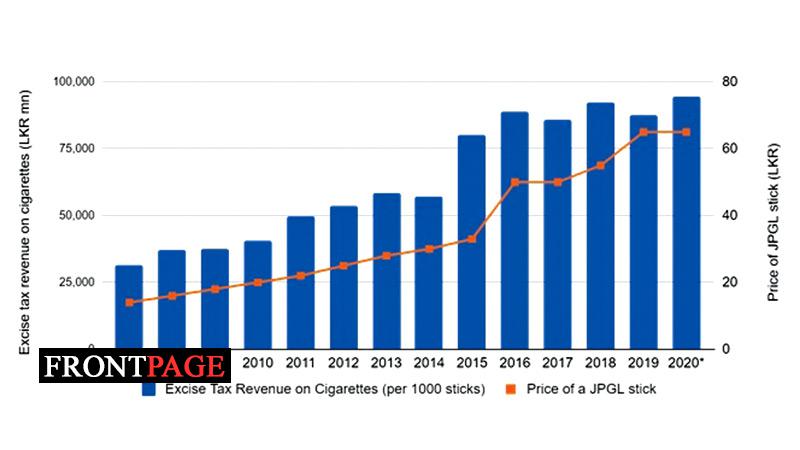

As illustrated below, the price of the most consumed cigarette brand in Sri Lanka, John Player Gold Leaf has increased gradually but considerably over the past decade.

Concurrent to the above has been the rise of illicit cigarette trade, more specifically illicit importation – cigarettes produced/bought in one, low cost, jurisdiction then illegally transported to another, high profit jurisdiction, to avoid applicable taxes. In addition to the high prices for legal cigarettes in Sri Lanka, other factors such as weak boarder control and the low risk-high reward nature of penalties in the illicit cigarette industry result in making Sri Lanka a smuggler’s paradise. Based on primary research findings, RIU’s latest report estimates that 21% of cigarettes consumed in Sri Lanka in 2021 were illicit.

The illicit share has gradually increased over the last decade from less than 10% in 2012 to 21% in 2021. A market shares of 21% means a fiscal revenue loss of approximately LKR 27 billion for the year 2021.

To put things into perspective, the LKR 27 billion amount could have for instance funded brand new laptops for over 300,000 students.

A common term in the illicit market is ‘bootlegging’, which is the purchase of cigarettes from low or no tax jurisdictions for resale in higher tax jurisdictions without appropriate taxes being paid. This can include direct smuggling where smugglers use illegal entry points to avoid customs inspection and directly introduce tobacco products via sea or land from neighbouring countries.

These operations implement deceptive methods such as concealing cigarettes in secret compartments aboard ships, food, vehicles or vehicle parts, wood, luggage, furniture, toys, boats, tires, textiles. Smuggled cigarettes avoid various restrictions and health regulations, such as requirements for Graphic Health Warning labels (GHWs) in the local language. They can pose serious health risks for its users as quality standards are not verified.

The street value of a container of illicit cigarettes can be worth approximately LKR 700 million. However, the maximum fine in Sri Lanka for smuggling a large container load of cigarettes is only LKR 1 million. Consequently, smugglers make substantial profits by exploiting the system which is lenient on punishment and lucrative in terms of the market.

Criminal networks are able to expand through the trafficking of illicit tobacco products, facilitating and providing funding for other criminal activities.

Listed below are some recent examples of noteworthy, smuggled cigarette seizures in Sri Lanka.

u A container containing 150,000 smuggled Chinese cigarettes, worth LKR 9 million was seized in March 2021. These cigarettes were hidden in iron pipes.

u In May 2021, over 200 million cigarette sticks were attempted to be illegally imported into the country from the Jebel Ali Port in Dubai. This stock was fortunately seized by Sri Lanka Customs thereby protecting the country from a fiscal revenue loss of ~LKR 9 billion.

u The Police Narcotic Bureau arrested three persons and recovered 212,000 sticks of smuggled cigarettes worth over LKR 10 million in May 2021.

u In June 2021, Sri Lanka Customs has found a shipment of 276,000 cigarettes worth over LKR 24.8 million. These illegally imported Chinese-made cigarettes were hidden in small chair-like boxes.