Manufacturers are having to deal with lower prices from buyers, increased costs of raw materials, economic slowdown due to rising inflation, excess inventory, and subdued customer sentiment has compelled major manufacturing units in Asia to operate at 60-70% capacity and to accept orders at minimal margins to sustain production. In this setting, most suppliers who work with us are eager to explore new strategies to improve margins by driving main manufacturing KPIs such as Receive-To-Ship (RTS) and Cut-To-Ship (CTS) using our repair and restoration capabilities which triggered the current demand for our services.

This is the tip of the iceberg and anticipate a further surge in demand for repair services as pressure from the Western world, especially the EU, intensifies with nearly 60 new regulations affecting the fashion industry. This article delves into challenges, opportunities and key regulations facing apparel manufacturers amid rapid changes in EU legislation, addressing the growing legal demand for circular textiles. This pivotal shift in expectations mandates a transformation within the apparel sector to align with evolving demands of the fashion market.

Paradigm Shift in the Garment Industry

The Paris Agreement, established in 2015, is a landmark treaty involving 196 countries, including Sri Lanka, with the goal of limiting global temperature rise. The first global stocktake to assess progress COP28 Conference in Dubai commenced on November 30, 2023. The outcomes of COP discussions can significantly impact global fashion supply chains, making it an essential platform for industry professionals to address key issues. While fashion’s historical presence at COP has been limited, influential entities like LVMH, Eco-Age, and Global Fashion Agenda are increasingly participating.

Apparel industry is the 2 nd most polluting industry and contributes 10 percent of global greenhouse gas emissions, the impact on the environment is notably significant. Furthermore, the current recycling rate for clothing is less than 1 percent, resulting in a growing issue of landfills and pollution. And, as 2030 has been set as the target year for full circularity in the EU market, pressure from regulatory bodies is ever increasing. Given this, apparel manufacturers will soon face stressors across different dimensions including circularity, traceability, and decarbonization.

Future Regulations affecting Fashion Industry

There are over 60 different legislative initiatives with potential implications for apparel manufacturers. Legislators in the Global North are making significant moves to enact sustainability- related legislation. While these laws originate from places such as the EU, United Kingdom, and the United States, they will impact companies operating outside of these jurisdictions. While suppliers may not, in all cases, be directly subject to the obligations created by these Global North laws, they may still experience knock-on effects as they form an integral part of the global apparel value chain and produce goods for multinational brands and retailers who have increasing compliance obligations. Here are very few of the key regulations.

1. CSRD (Corporate Sustainability Reporting Directive): Starting in 2024, it applies to 10,000+ organizations, requiring disclosure of social and environmental impacts across the global supply chain.

2. CSDDD (Corporate Sustainability Due Diligence Directive): Obligates EU fashion brands and their suppliers to investigate and address harmful environmental and human rights effects.

3. EU Sustainable Finance Taxonomy: Directs investments into circular economy practices, compelling fashion companies to disclose environmental impacts throughout their supply chains.

4. New York Fashion Act: Expected to mandate due diligence and reporting, enhancing transparency on the environmental and social impact of apparel and footwear production.

5. Digital Product Passport (DPP): Requires foundational systems for visibility from raw materials to finished goods, ensuring adherence to quality, sustainability, and circularity.

Fashion Waste

The global textile industry, valued at $1.8 trillion, produces a staggering 150 billion garments annually, almost 19 items per person on Earth. The fashion sector generates a massive 92 million tons of waste each year, equivalent to one garbage truck of clothes discarded or incinerated every second.

When addressing textile waste, at most times the topic revolves around fast fashion and the disposal of clothes at the end of their life, known as post-consumer waste which has emerged as a significant challenge, particularly in the global north. But there is already a problem a few steps back in the manufacturing process which refers to as pre-consumer waste, all the waste materials that are created in the supply chain during manufacturing of a product. Research estimates suggest that up to 47% of fiber entering the fashion value chain becomes waste at various production stages, highlighting the substantial environmental impact of pre- consumer waste. Most common pre-consumer waste happens, firstly, due to over ordering, manufacturers order 3- 10% more material than necessary and secondly due to inconsistencies in fabric. Thirdly, cutting residues, when fabrics are marked, laid, and cut out into desired shapes and sizes, even with conscious effort as much as 8-12% of the fabric, referred to as textile scraps and roll ends can end up on the cutting room floor.

Producing textiles in large volumes often leads to weaving errors, printing mistakes, and color variations. In the inspection stage, when these defects are identified in large fabric rolls, one common approach is to cut the fabric into smaller rolls using the Acceptable Quality Level (AQL) system, which establishes the permissible number of defects in a single fabric roll. However, while this quality control method fits a linear model, it doesn’t align well with the principles of circularity.

A more circular-friendly approach would involve cutting rolls to match multiples of the marker length, thereby reducing cut pieces and roll ends. This shift supports the aim of minimizing waste and optimizing resource utilization in a circular fashion model.

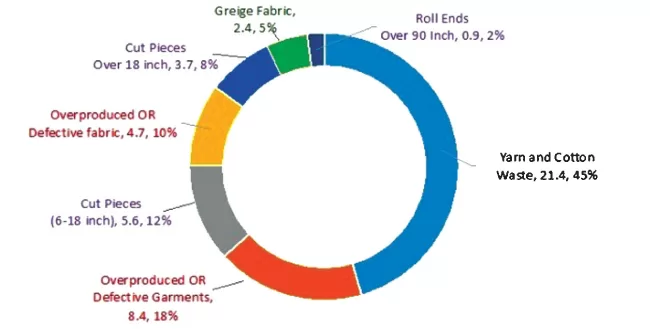

Here is the breakdown of this 47% waste.

Yarn and Cotton Waste, 21.4, 45%, Overproduced OR Defective Garments,8.4, 18%, Cut Pieces (6-18 inch), 5.6, 12%, Overproduced OR, Defective fabric, 4.7, 10%, Cut Pieces Over 18 inch, 3.7, 8%, Greige Fabric, 2.4, 5%Roll Ends, Over 90 Inch, 0.9, 2% Yarn and cotton waste contribute to 21.4% of total wastage.

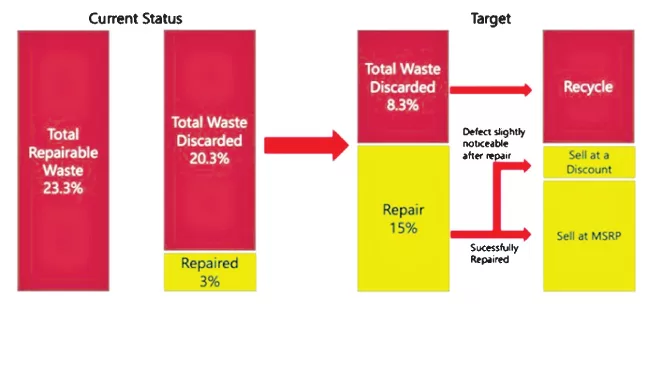

Although some systems recover value from cutting-room waste, much of it is downcycled, losing its highest value. Balance 23.3% of the waste is attributed to over-produced and defective fabric and garments (13.1%) as well as cut pieces and roll ends (10.2%), primarily stemming from sub-optimal processes and human negligence. This type of waste is frequently sold at a discounted rate or, regrettably, incinerated or sent to landfills. Adopting time-tested practices such as mending or repairing defects within the supply chain could substantially diminish this waste.

Waste to wealth

If at least 10-15% of (23.3% of repairable waste) this quantity can be transformed into finished products and then repaired to export standard, manufacturers could achieve significant cost savings, possibly reaching millions.

This offers a prime opportunity for brands and manufacturers to generate extra revenue without the necessity of producing new clothes. Successfully repaired garments can be sold at full price, while those with minor defects could be discounted, and sold in secondary markets such as the preloved fashion market.

Significance of Garment Repair for Circular Economy

Garment repair is a promising circular business model for reducing pre-consumer industrial waste by repairing and restoring damages found in the textile manufacturing process. Repairing extends the life of a garment, preventing it from becoming waste and reducing the demand for virgin material.

Repairing a new garment is far easier than repairing a used, worn-out garment. As per calculations published by research organizations, repairing one garment can conserve approximately 10-20 kgs of CO2, 2,000 litres of water, 30Kw of electricity and 10 kgs of waste. Compreli have repaired and restored 7 million garments to-date and as per the above calculation, this achievement is equivalent to conserving 70,000 metric tons of CO2, saving 3.6 billion gallons of water, preserving 210,000 MW of electricity, and preventing 70,000 metric tons of waste, whilst generating USD 7-10 million in bottom line savings to textile manufacturers.

The implementation of the digital product passport (DPP) will amplify transparency, exposing hidden waste. Taking a proactive stance to address this waste is crucial, presenting manufacturers and brands with opportunities to boost revenue whilst driving circularity within the supply chain. One crucial aspect is the need for companies to transcend the traditional mindset of competition and embrace collaboration. Companies must recognize that the circular economy is not a zero- sum game; success for one company doesn’t come at the expense of another. Instead, it necessitates a collective effort to redesign entire systems and value chains for sustainability. As the African proverb wisely notes, “If you want to go fast, go alone. If you want to go far, go together.”

The post Waste isn’t waste until we waste it…. appeared first on DailyNews.