Lanka’s real GDP contracted by 3.6 % in 2020- KPMG Sri Lanka

The Sri Lankan arm of KPMG has made public its observations on the 2022 Budget. Here are excerpts of the report which has prepared by KPMG Managing Partner Rheyaz Mihular and his team.

Sri Lanka’s real GDP contracted by 3.6% YoY in 2020, primarily on account of the COVID – 19 pandemic impact on the global and local economy, which was further exacerbated by adverse weather conditions at the beginning of the year.

Accordingly, the country recorded a nominal GDP of USD 81.1 Billion in 2020 and remained a lower middle-income country with a GDP per capita of USD 3,682 during the same period.

However, with the gradual recovery of the economy, strengthened by vaccine rollouts, Sri Lanka recorded an economic growth of 8.0% YoY during the 1H2021.

Looking forward, the Central Bank of Sri Lanka (CBSL) expects the economy to grow by 5.0% in 2021 while the World Bank and the International Monetary Fund (IMF) expects a more conservative growth of 3.4% and 4.0% respectively, on account of a resumption in domestic trade, consumption and manufacturing buoyed by the local vaccine roll-out.

SECTORAL DISTRIBUTION OF GDP

The Agriculture sector contracted 2.4% YoY while the Services and Industry sectors, contracted by 1.5% YoY and 6.9% YoY respectively in 2020. However, the economy witnessed a v-shaped recovery in all sectors in 3Q2020 with the gradual resumption of economic activities post lifting of lock downs.

Tourism, Sri Lanka’s third largest generator of foreign exchange, suffered a significant setback in 2020 with only 507,704 tourist arrivals in the few months the country’s borders were open. The dismal performance in 2020 followed the Easter attacks in 2019, which caused tourist arrivals to drop to 1.9 Million during the year from the 2.3 Million arrivals recorded in 2018.

Unemployment rose steadily in 2020 and reached a high of 5.8% in 3Q 2020. The negative impact of the pandemic continued onto 2021 with unemployment reaching 5.7% in the 1Q 2021.

INFLATION

Inflation as measured by the National Consumer Price Index (NCPI) reached 6.2% Year- on- Year (YoY) (measured as a 12-month moving average) in 2020, notwithstanding lower consumption and import restrictions on selected consumer and non-consumer goods. Notably, food inflation rose to 12.2% YoY in 2020 due to the restrictions on select food imports and disruptions to domestic supply chains.

Supply shortages exacerbated by import restrictions continued onto 2021 as witnessed by the NCPI and CCPI rising sharply from January 2021 to September 2021 at 5.6% and 4.6% on a monthly average inflation level, respectively.

INTEREST RATES

In order to stimulate the economy from the fall out of the COVID – 19 pandemic, the CBSL lowered key policy rates five times in 2020, resulting in the standing deposit facility rate and the standing lending facility rate to fall by 250 bps during the year. The Statutory Reserve Ratio (SRR) was also reduced on this background.

Accordingly, the Average Weighted Prime Lending Rate (AWPLR) declined from 9.9% in January 2020 to 5.7% in December 2020. However, commercial lending rates have picked up in 2021 as indicated by 6.5% AWPLR as of October 2021.

The CBSL granted debt moratoria and introduced credit guarantee schemes for affected industries during the pandemic which continue to be in place in 2021.

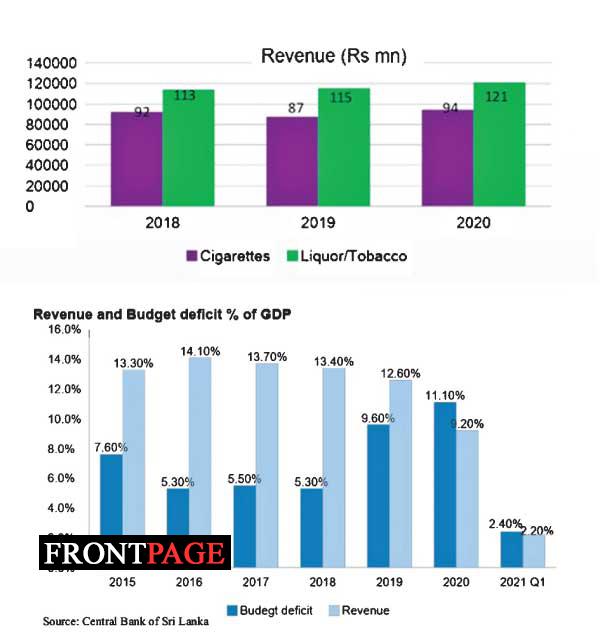

FISCAL BALANCES

Sri Lanka’s budget deficit widened from 9.6% of GDP in 2019 to 11.1% of GDP (amounting to LKR 1,667.7 Bn) in 2020, on account of the economic slowdown, high relief expenditure and post-Presidential Election 2019 tax cuts.

The post -election tax cuts notably caused tax revenues to decline from 12.6% of GDP in 2019 to 9.2% of GDP (amounting to LKR 1,373.3 Billion) in 2020, which was further impacted by a decline in the import related tax collection that was challenged by import restrictions during the year.

The impact of the tax cuts and the pandemic continued onto 1Q2021, resulting in a budget deficit of LKR 520.5 Billion that notably exceeded 1Q2021 revenue of LKR 481.7 Billion, during the year.

GOVERNMENT DEBT

Total debt service payments for 2020 amounted to USD 4.3 Bn, of which USD 2.8 Bn was principal repayments and the balance USD 1.5 Bn was interest payments.

On this note, the country’s debt-to-GDP ratio stood at 101.0% at the end of 2020.

As at end-April 2021, the GoSL’s outstanding foreign debt was USD 35.1 Bn with International Sovereign Bonds (ISBs) accounting for 46.7% of the foreign currency debt stock (USD 16.4 Bn). Notably, over USD 5.0 Bn in foreign debt repayments is expected to be made in 2022 and beyond.

In its six- month road map presented in October 2021, the CBSL announced its target to reduce the Government’s ISB exposure to 10.0% of GDP by 2024. As of end 2020, Sri Lanka’s gross official foreign reserves fell to USD 5.7 Bn as a result of repaying a USD 1.0 Bn sovereign bond maturing in October 2020, instead of rolling over.

The above was despite the worker remittances growing 5.8% YoY during 2020, while the trade deficit contracted 25.0% YoY to USD 6.0 Bn on account of lower imports.

FOREIGN RESERVES

Reserves continued to decline in 2021 post another sovereign bond repayment of USD 1.0 Bn in July 2021, to a significant low of USD 2.3 Bn as of October 2021.

In lieu of over USD 5 Bn in foreign debt repayments expected amidst the challenging macro- economic environment in 2022, S&P downgraded Sri Lanka’s credit rating to CCC+ in August 2021 followed by Moody’s downgrading the sovereign to Caa1 in October 2021.

DEBT SUSTAINABILITY

Debt sustainability issues exacerbated by unfavorable economic conditions stemming from the COVID – 19 pandemic, contributed towards the depreciation of LKR which declined 2.6% against the USD in 2020. The volatility of LKR continued onto 2021 whereby the LKR depreciated by 8.9% against the USD from January to end October 2021. Depreciation against Euro,Australian Dollar, Sterling Pound and Indian Rupee was also witnessed.

To curtail the significant exchange rate loss, the CBSL imposed import restrictions via bank suspensions for motor vehicle imports and all non-essential goods, introduced Special Deposit Accounts (SDAs) with higher-than-market interest rates for dual citizens and enacted mandatory conversion rules for export proceed receipts.

To curtail the significant exchange rate loss, the CBSL imposed import restrictions via bank suspensions for motor vehicle imports and all non-essential goods, introduced Special Deposit Accounts (SDAs) with higher-than-market interest rates for dual citizens and enacted mandatory conversion rules for export proceed receipts.

SURCHARGE TAX

We note that a surcharge on Income Tax has been imposed from time to time in Sri Lanka since 1961. Surcharge on Income Tax imposed for the following Years of

Assessment, ranged between 10% to 20%;

− 1960/1961, − 1978/1979 to 1981/1982

− 1984/1985, − 1989/1990 to 1995/1996

− 2001/2002.

From 2005 – 2011, a similar levy was imposed in the form of Social Responsibility Levy (“SRL”) at the rate of 0.25% (which was gradually increased to 1.5%) on all taxes chargeable under the enactments specified under the Act. (i.e., Inland ‘Revenue Act, Customs Ordinance, Excise Ordinance and Excise (Special Provisions Act)

In 2015, a Super Gain Tax was imposed at the rate of 25% on taxable income of an individual or a company for the Year of Assessment 2013/2014, where the profits as an individual entity or as a Group exceeded Rs. 2 billion.

This proposal will have to be further studied to understand the base on which the tax would be imposed, to ascertain the scope of changeability.

It is proposed to increase the VAT on Financial Services rate payable by the Specified institutions

to 18% from 15%. This rate increment will be applicable only for a period of one year commencing on 01 January 2022 and ending on 31 December 2022. The expected revenue by the Government from the increased rate is Rs.14 Billion.

Specified Institutions cover a licensed commercial banks, a finance companies and a licensed specialized banks.

VAT ON FINANCIAL SERVICES

The VAT on Financial Services was introduced in 2003 at the rate of 10% and it was chargeable on the supply of financial services by Specified Institutions. Subsequently, through amendments the chargeable person was extended to cover both Specified Institutions or persons carrying on the business of supplying defined financial services.

As per the Department of Inland Revenue Annual Performance Report for 2020, the revenue collection from VAT on FS is as follows;

VAT EXEMPTIONS

The tax exemption granted on import or supply of goods listed under item (xxxi )of paragraph (a) of Part II to the First Schedule to the Act would be amended as follows.

“medical equipment, machinery, apparatus, accessories and parts thereof and hospital furniture, drugs and chemical donated to a Government hospital or the Ministry of Health for the provision of health services to address an pandemic or public health emergency approved by the Ministry of Finance on the recommendation of the Secretary to the Ministry of the Minister assigned with the subject of health with effect from January 1 2022.”

As per the above amendment tax exemption on “surgical and dental instrument” has been removed.

SPECIAL GOODS AND SERVICES TAX

The Special Goods and Service Tax (GST) which was proposed in the Budget 2021 is proposed to be implemented from 01 January 2022.

In the Budget 2021, it was stated that an online managed single special goods and services tax would be proposed on telecommunication, motor vehicles, cigarettes, liquor, betting and gaming in lieu of various taxes and levies imposed under different Acts and administered by different.

It is mentioned in the Budget 2022 speech that the legal provision in relation to GST is already drafted. We await the draft Act for guidance on rate and collection mechanism.

The following is a synopsis of the current indirect taxes applicable on the aforementioned industries.

Telecommunication Services

Currently, the telecommunication services are subject to Telecommunication Levy,

Cess (administered by the Telecommunications Regulatory Commission) and VAT (administered by the Department of Inland Revenue). The telecommunication industry first witnessed the composite tax called Telecommunication Levy in lieu of VAT and NBT in 2011. Later, in 2016, VAT and NBT were re-imposed on telecommunication industry in addition to the Telecommunication Levy. NBT was discontinued from December 2019.

Motor Vehicles

A composite tax was introduced in 2014, on motor vehicles specified under Chapter 87 of the tariff guide for both import and supply of such vehicles in lieu of VAT and NBT.

In addition to the composite tax, Custom Duty and Port and Airport Development Levy are imposed at the point of importation. Further, Luxury Tax on Motor Vehicles was introduced in 2019 in lieu of Annual Luxury Motor Vehicle Tax on prescribed motor vehicles. ESC imposed on importation of motor vehicles w.e.f. April 2017 was discontinued from January 2020.

Special Goods and Service Tax (Cont.)

Indirect Taxes Cigarettes and Liquor

Currently, cigarettes and liquor are subject to Excise Duty and VAT. A composite tax was introduced in 2014, for cigarettes and liquor in lieu of VAT and NBT. However, VAT and NBT was reintroduced from November 2016 on cigarettes and liquor in addition to the Excise Duty. NBT was discontinued from December 2019.

Betting and Gaming

Currently, the business of betting and gaming is subject to VAT or to an annual levy for carrying on the business of gaming and a levy on gross collection of the business as the case may be. Further, a Casino Entrance Levy is imposed and collected from the persons entering such places of gaming.

Social Security Contribution

It is proposed to introduce a 2.5% levy termed “Social Security Contribution ”on excess over annual turnover Rs.120 million, to rebuild the economy affected by the COVID pandemic with effect from 01 April 2022.The expected revenue by the Government from the levy is Rs.140 Billion.

In order to enhance the efficiency, it is proposed to expedite the digital revenue collection system and measures be taken to simplify the excise licensing process. It is proposed to increase the excise duty with immediate effect.